Loss Prevention User Guide

Welcome to the Avero Loss Prevention Guide. Inside you will find a walkthrough of each Loss Prevention Watch Type along with tips, tricks, and best practices to help you effectively use Avero Loss Prevention to identify and mitigate theft in your restaurant and tighten SOPs. Loss Prevention is a tool designed to identify behavioral patterns that are indicative of fraud, theft, or loss. With the tool, you can not only identify employee behavior that is suspicious but also identify broader operational vulnerabilities in your restaurant. Identifying and doing away with these bad practices will make your operation less vulnerable to profit loss through employee theft.

Read on to become a Loss Prevention expert!

In this article:

See Also:

- Loss Prevention Settings Guide

- Adding New Users to Loss Prevention

- Loss Prevention Terms Glossary

- Loss Prevention FAQs

Choosing a User

Loss Prevention is not a tool we recommend everyone in your organization use due to the sensitive information uncovered. Loss Prevention tool is designed for complex operations, such as casinos and hotels, with a Finance or Analyst position approach. If you are a small operation (less than a dozen restaurants of similar concept, just a few revenue centers per location) we recommend our article on Preventing Theft, Abuse, and Fraud. We also recommend training your floor managers on these daily and weekly habits to keep a tight operation.

A manager who spends time on the floor during service, applies/approves voids and promotions, and has personal connection with the employees often doesn't have the time to devote to investigation and is sympathetic toward the plight of your line-level staff, distracting them from instituting function.

While the end result of our Loss Prevention tool is sometimes uncovering fraud and theft, it really highlights vulnerabilities and shows your above-store team how to tighten SOPs across the organization and reduce opportunities for malfeasance.

How to Navigate Loss Prevention

Get to Loss Prevention via the Navigation Pane:

If you don't see Loss Prevention listed, you haven't been granted access, reach out to your admin to provision access. See our guide to inviting users: Adding New Users to Loss Prevention

Alert Summary

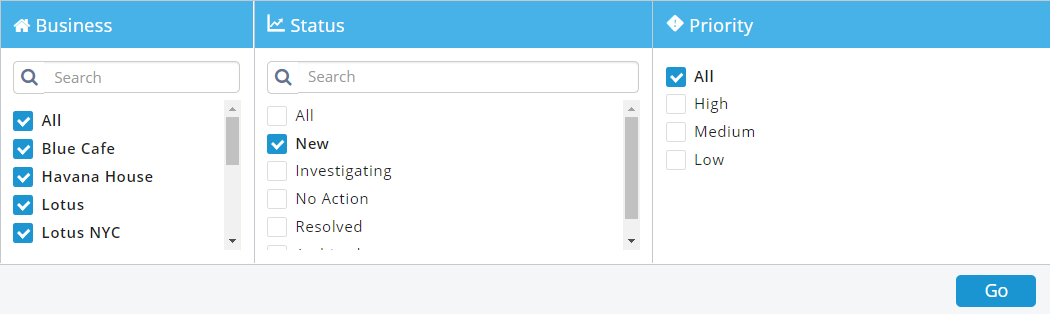

Use the Report Generator to filter your alert summary by business, statues, and priority.

The alert summary will summarize case matching your search parameters, from there you can click on any case to view the case details.

Case Details

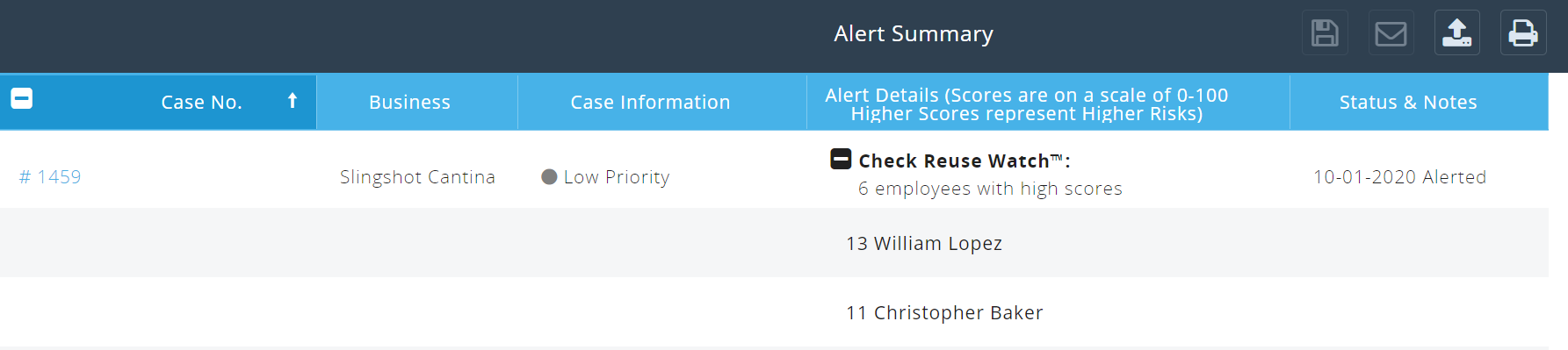

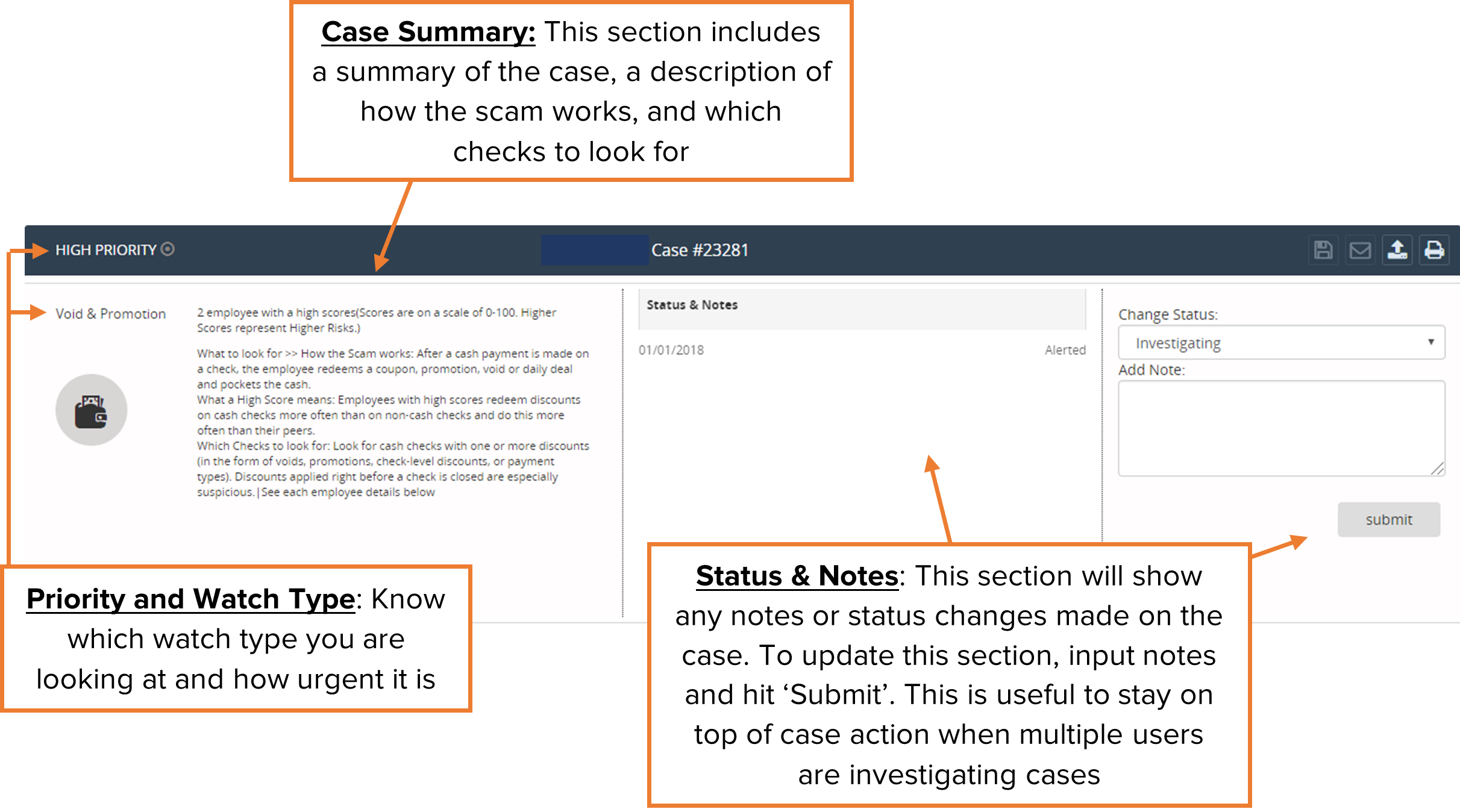

Open the case to view the case details - a summary will be at the top.

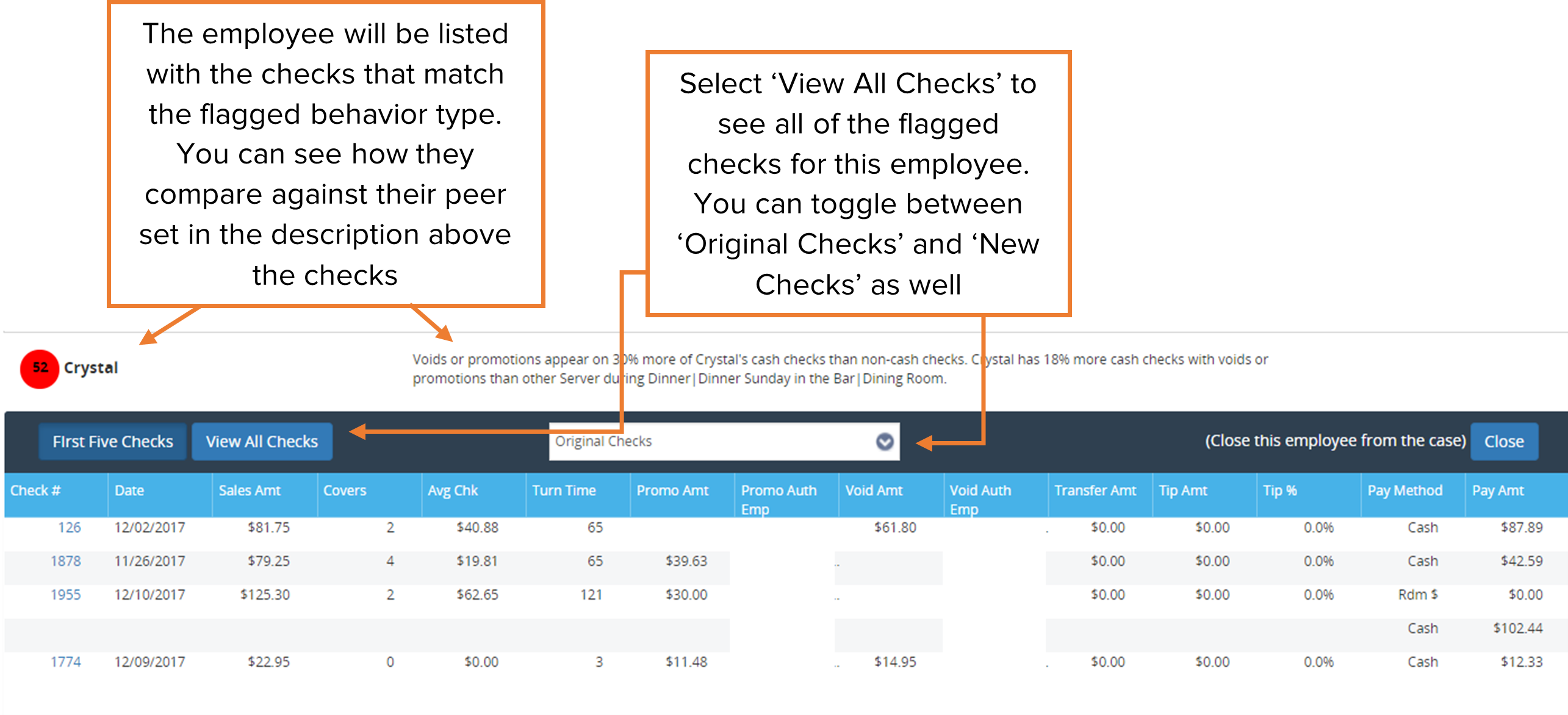

Scroll down to view the details within the case - which employees have been flagged, dive into the checks that have been highlighted, and parse for concerning activity.

Alert Types

Avero will parse all of your restaurant's data and filter out items that may indicate opportunities for improvement or investigation. You don't need to run reports here, Avero filters the relevant activity into your Alert Summary. New cases are generated at the beginning of the month, so early in the month is the best time to check Loss Prevention and take action to reduce loss.

Watch Type Alert: Highlights the employees at an outlet with scores in the same watch type

Why: Opportunities to improve practices to reduce the number of high watch scores

Employee Alert: Draws your attention to an employee who has scored in multiple watch types

Why: Indicates employees who need additional training or may be committing fraud

Trend Alert: Identifies behaviors that shift over time - an outlet or employee has a significant score increase for a watch type

Why: Indicates potential increases in fraudulent activity or a loosening of established standards

Read on for a deep dive into each Watch Type:

Check Reuse

How the Scam Works:

Employees are recycling checks from table to table when guests pay with cash, pocketing the cash payment each time until a guest pays with a credit card. This is most common in environments with common items ordered by every guest (e.g. Buffet, Coffee Shops).

What a High Score Means:

Employees with high scores have fewer cash checks each hour than their peers and have corresponding non-cash checks that were open for longer than normal.

Which Checks to Look For:

Look for checks with long turn times that were closed to a non-cash payment that contains only a few common items that any guest in the outlet would order.

Questions to Ask:

Does the server need a ticket from the POS to get these items, or are they “server controlled” items? Did other employees in the same shift have more case checks than this server? Is this item one that is ordered by many guests in the outlet?

POS Authorization

How the Scam Works:

An employee is able to use a void or promotion without an authorization or with an unauthorized code on a cash transaction, pocketing the cash.

What a High Score Means:

Employees with high scores use discounts on cash checks without valid authorization more often than the same discounts on non-cash checks.

Which Checks to Look For:

Look for cash checks with a void or promotion where the authorizing employee is not a manager or where the employee is able to authorize their own discounts. Also look for cash checks where there are multiple voids or promotions and different managers authorizing each one, or cash checks where there is no authorizing employee listed.

Questions to Ask:

If the employee is able to authorize his or her own promotions, what are the checks and balances in place to monitor for abuse? Are there any changes that can be made to the POS to ensure that manager authorization is required for every void or promotion? Is there a pattern with the employee and manager who appear on all of these checks?

Transfer

How the Scam Works:

Employees leave a check open during service and transfer items from cash checks to the open check. At the end of service, they promo or void all the items and pocket the cash.

What a High Score Means:

Employees with high scores frequently transfer items from multiple cash checks to a single check. They frequently keep checks open for a long time before reducing sales to $0 using voids or promotions.

Which Checks to Look For:

Find checks where the items were reduced to $0 using a void or promotion at the end of the shift. Investigate any checks that had transfers onto that check to make sure the transfers, voids, and promotions were all legitimate.

Questions to Ask:

What is the policy for transferring items from one check to another? Is manager authorization required? What checks and balances are in place for voids and promotions that take place at the end of the shift? Is there a pattern with the employee and manager who appear on these types of checks?

Void & Promotion

How the Scam Works:

After a cash payment is made on a check, the employee redeems a coupon, promotion, void or daily deal and pockets the cash.

What a High Score Means:

Employees with high scores redeem discounts on cash checks more often than on non-cash checks and do this more often than their peers.

Which Checks to Look For:

Look for cash checks with one or more discounts (in the form of voids, promotions, check-level discounts, or payment types). Discounts applied right before a check is closed are especially suspicious.

Questions to Ask:

When a manager authorizes a void or promotion, do they do any service recovery with the guest to ensure that the discount is legitimate? Is there a pattern in the type of promotion or void used by the employee? Or a pattern in the type of items that are discounted? Is there a pattern with the employee and manager who appear on these checks?

Tip Inflation

How the Scam Works:

Employees shift money from the item sales to their tip on a non-cash check by using a promotion or void to reduce the sales amount and inflating the tip to match the previous total so the guest won’t see a different amount on his/her credit card statement.

What a High Score Means:

Employees with high scores frequently redeem a discount on a non-cash check that then has a void or promotion, and they have this pattern more frequently than their peers.

Which Checks to Look For:

Look for non-cash checks with high tip amounts and a void or promotion. Voids and promotions applied right before a check is closed are especially suspicious.

Questions to Ask:

Are employees able to apply a promotion or void after the check has been printed from the POS? When a manager authorizes a void or promotion, do they do any service recovery with the guest to ensure that the discount is legitimate?

Auto Gratuity

How the Scam Works:

Employees deceive guests into paying additional gratuity by adding an auto gratuity or service charge to the check without telling the guest, who leaves an additional tip.

What a High Score Means:

Employees with high scores have a large proportion of checks with a service charge or auto gratuity where the guest has left an additional tip, inflating the tip percentage above normal levels.

Which Checks to Look For:

Look for checks where the tip amount is larger than normal, where there is a service charge or auto gratuity in addition to the credit card tips or direct tips.

Questions to Ask:

Do these checks appear to follow the auto gratuity or service charge policy at the location (e.g. more than 8 guests have 20% gratuity included)? If not, how can the POS settings be altered to ensure that service charges are only added to appropriate checks? Are the servers trained to mention to the guest that the gratuity is included when they drop the check at the table?

Comp

How the Scam Works:

Employees identify a transaction that will be 100% complimentary (e.g. VIP). They transfer items from cash checks to the comp check, pocketing the cash from the original transaction.

What a High Score Means:

Employees with high scores often transfer items from cash checks to comped checks or exhibit this behavior more frequently than their peers.

Which Checks to Look For:

Find checks where the payment was reduced to $0 using a comp or promotion. Investigate any cash checks that had transfers onto the comp check to make sure the transfers were legitimate.

Questions to Ask:

If there are regular VIP comps at this location, does the manager who authorizes the comp to make sure that all the items on the check are actually from that guest? What is the policy for transferring items from one check to another? Is manager authorization required? Is there a pattern with the employee and manager who appear on all of these checks?

Resolving Cases

Once an investigation is complete, the case can be resolved with notes regarding the result.

Navigate to Case Details and enter the parameters to pull up the case in question.

On the right-hand side of the case, enter the resolution notes and select resolved from the drop-down status list. Add the Resolved Reason from the drop-down. Then hit Submit. A success message will appear.